Custom Automation Solutions for Prevailing Wage & Apprenticeship Reporting

The Inflation Reduction Act (IRA) has transformed the landscape for clean energy and infrastructure projects across the United States. While offering substantial tax incentives, it also introduces complex Prevailing Wage & Apprenticeship (PWA) requirements. As an expert automation and integrations agency, we're here to help you navigate these challenges with cutting-edge solutions tailored to your specific needs.

The IRA PWA Compliance Challenge

Companies across various sectors – from solar and wind to energy storage and green building retrofits – must meticulously track:

- Prevailing wage payments for all workers

- Apprenticeship hours (minimum 15% of total labor hours)

- Detailed payroll data from multiple subcontractors

Manual processing of this data is not only time-consuming but also risky, potentially jeopardizing valuable tax credits. This is where our automation expertise comes into play.

Our Automated PWA Document Processing and Reporting Solution

We specialize in creating custom automation systems that can:

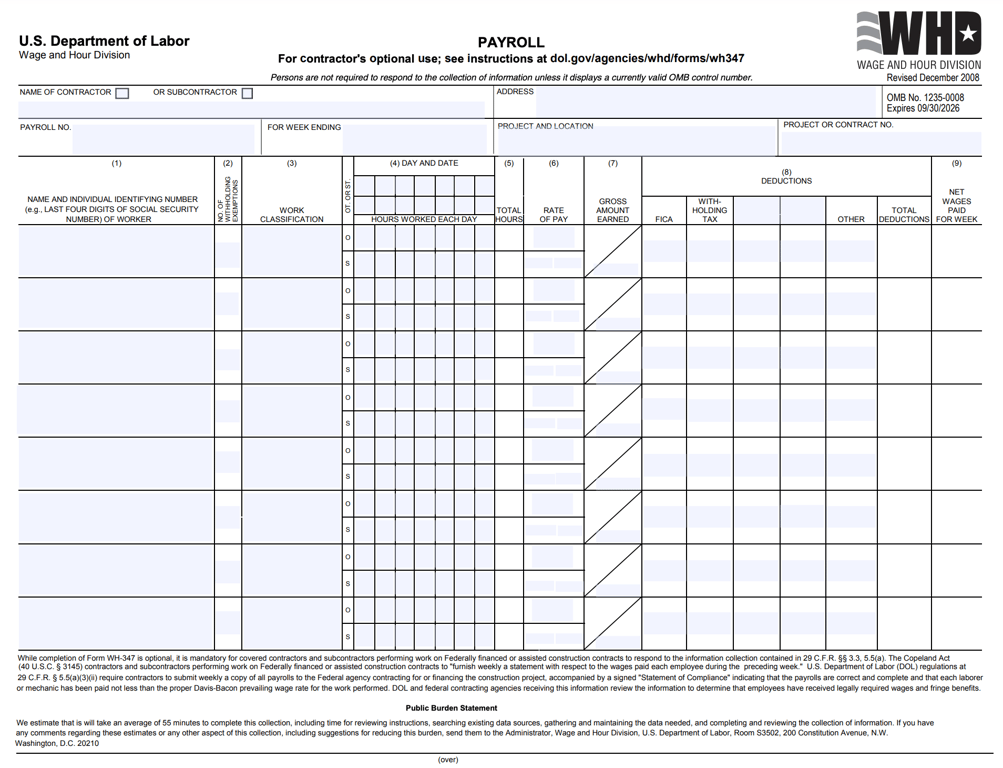

- Parse and extract data from various certified payroll formats:

- PDF documents using advanced OCR technology

- Excel spreadsheets with custom macros and formulas

- CSV files through intelligent data mapping

- Centralize information in robust, scalable databases tailored to your industry needs

- Generate real-time compliance dashboards and reports customized for your project types

- Proactively alert project managers to potential issues across multiple job sites

Key Benefits of Our IRA PWA Compliance Automation

- Time Savings: Eliminate hours of manual data entry with our automated parsing tools

- Improved Accuracy: Reduce human error in processing complex payroll data

- Real-Time Monitoring: Instantly track apprenticeship percentages and wage compliance

- Scalability: Handle projects with hundreds of workers across multiple subcontractors

- Audit Readiness: Generate comprehensive reports at the click of a button

Why Choose Our Automation Services?

- Expertise in diverse data formats: We excel at parsing complex PDFs, Excel sheets, and CSV files

- Database integration specialists: Whether you prefer Airtable, SQL, or cloud-based solutions, we've got you covered

- Scalable solutions: Our systems grow with your business, handling increasing data volumes effortlessly

- Compliance-focused design: Stay ahead of IRA requirements with built-in rule checking and alerting

- Continuous improvement: We offer ongoing support and updates to keep your system optimized

Real-World Success: Client Case Study

A multi-state clean energy contractor implemented our automation solution and saw immediate results:

- 85% reduction in time spent processing certified payroll across various document formats

- 99.9% accuracy in data extraction and compliance calculations

- Ability to take on 30% more IRA-eligible projects without increasing administrative staff

Conclusion: Automate Your Way to IRA PWA Compliance Success

As industries adapt to IRA requirements, robust automation will become not just an advantage, but a necessity. Our custom solutions for payroll parsing, data integration, and compliance reporting put you at the forefront of this revolution.

Are you ready to transform your IRA PWA compliance processes with state-of-the-art automation? Let's talk about how we can streamline your operations, ensure compliance, and maximize your tax credit potential.

Contact us today for a free consultation on building your custom PWA automation solution. From PDF parsing to comprehensive reporting, we'll design a system that meets your unique needs and keeps you ahead of the competition